Why Cycles?

Cycles are everywhere around us and the world we live in is without doubt cyclic in nature. The planets in our solar system orbit the sun, our moon orbits the earth in the lunar cycle, which causes consistent and predictable tides and seasons we experience month after month, year after year.

Humans divide their lives into time segments of days, weeks, months, years and so on. These are based upon natural cycles found in nature so it stands to reason that these cycles will present to some degree within the financial markets of world trade.

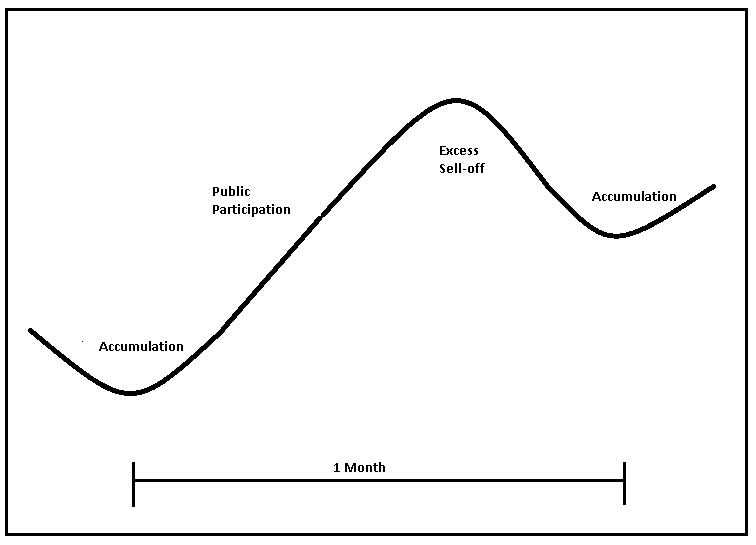

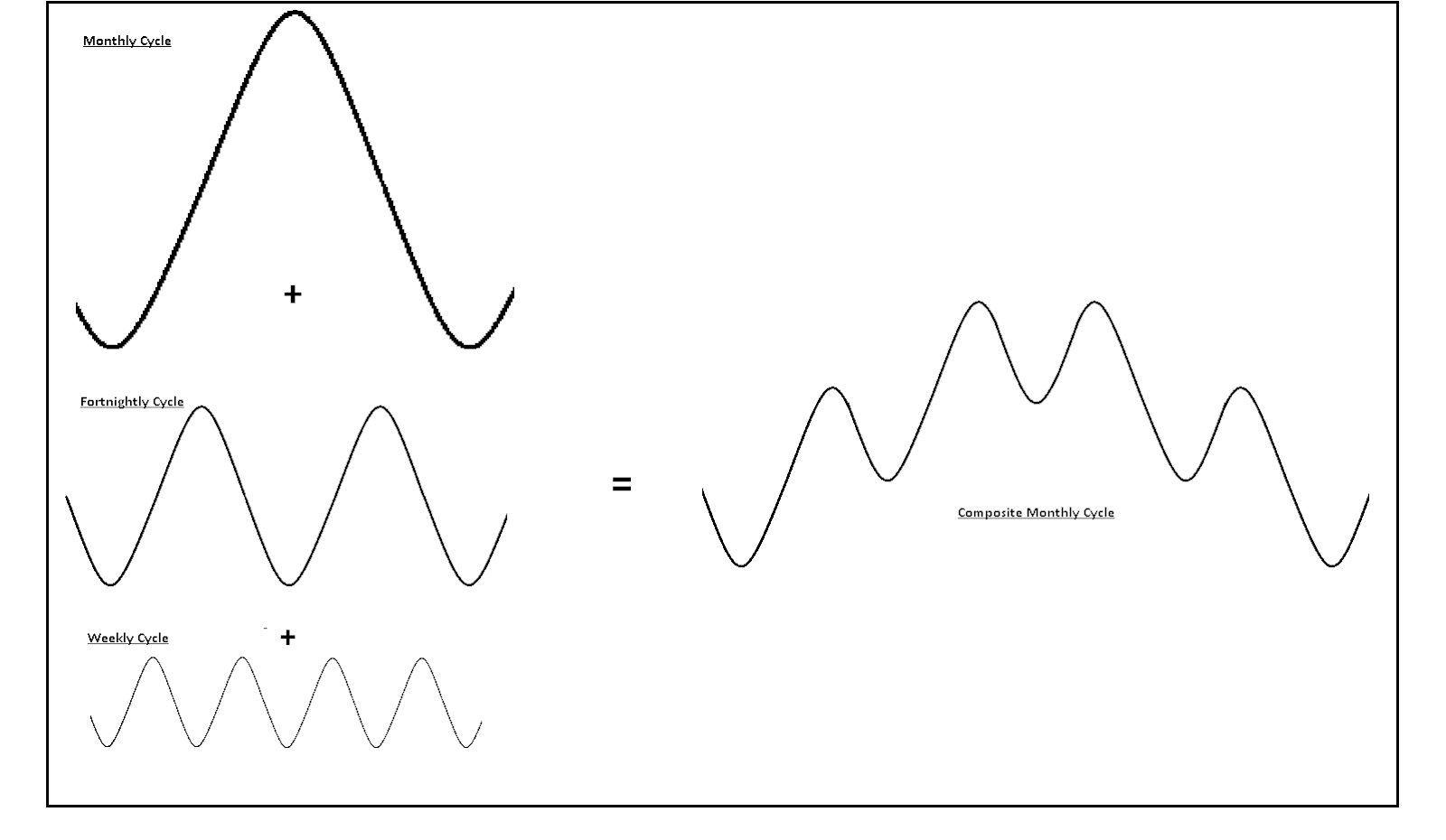

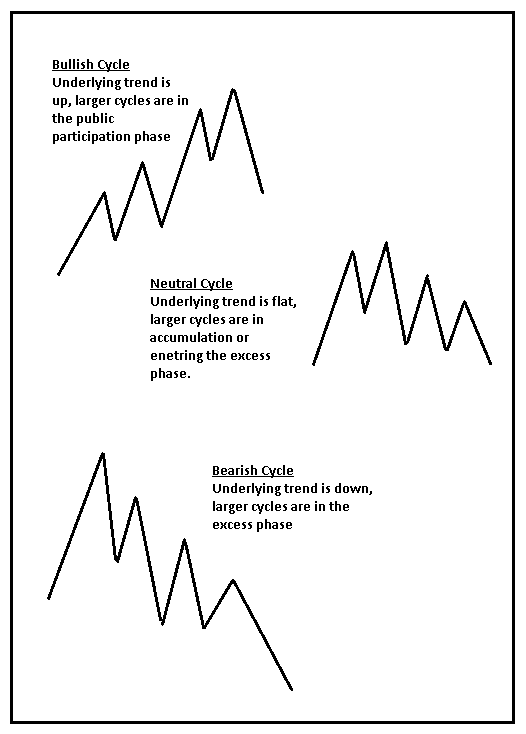

Of all the indicators, patterns and systems used to analyse world markets, the presence of relatively consistent cycles is universally agreed upon. Those cycles ‘generally’ present in the same time periods of one day, one week, one month and so on, but with some variation depending on the stock market being analysed . The following is a very simplistic synopsis of cyclic action and is solely intended to introduce the reader to the possibility of consistently tradable cycles operating in financial markets.

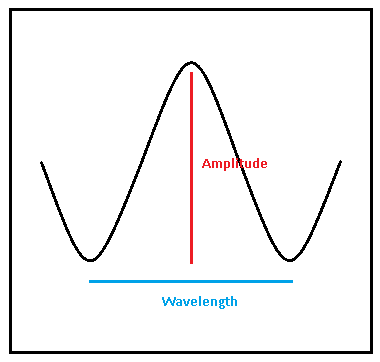

In simple terms, a cycle can be defined when a price starts low, rises smoothly and without interruption to a high, this gives a time the cycle has taken to reach its half way point. If it then descends in the same manner and in the same length of time to the low it stated from we say it has completed one cycle. If this price movement repeats its movement over the same or similar length of time it can be called a periodic cycle.